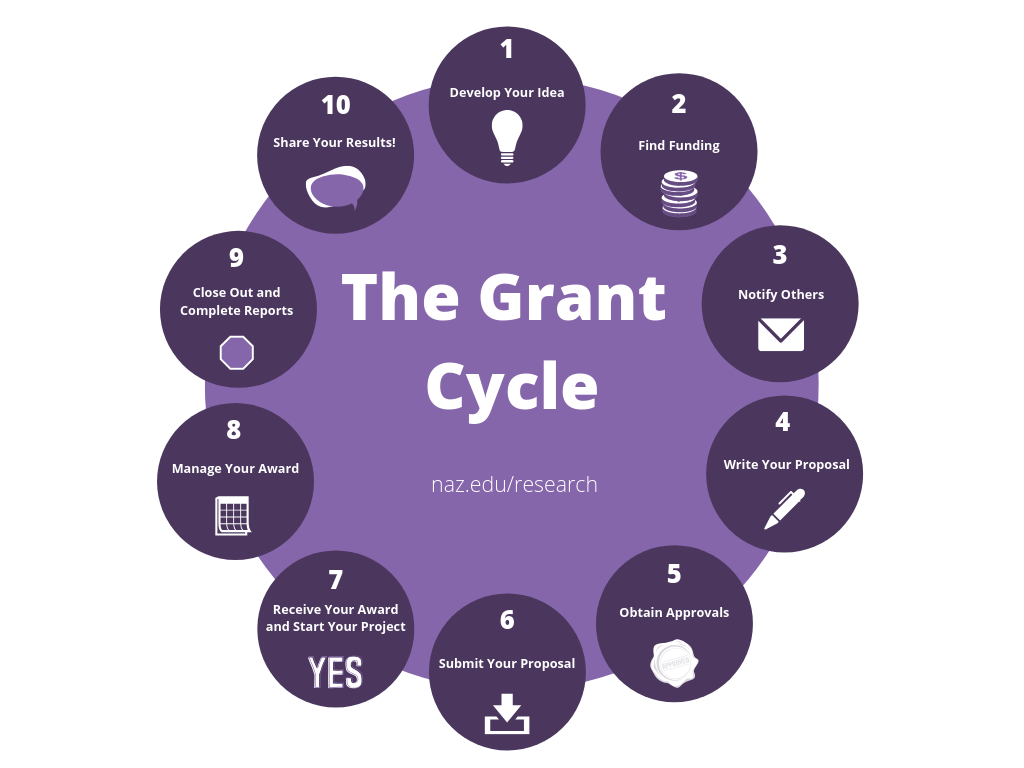

External Funding

We are here to help faculty secure and manage external funding. Find out how to seek and secure external funding, and get more information on the grants cycle.

Application Process

Step 1: Develop Your Project Idea

The key here is that it is YOUR project! Often faculty new to grants try to find a funding opportunity first and then create a project to fit that grant. This is not in your best interest! To make your grant proposal strongest, start by having a clear idea of what you want to do, understand its impact, and get feedback from others. You want to find funding to fit YOUR project, not the other way around.

Step 2: Search For Potential Funding

It sounds simple, but Google can be a great place to start. In addition to "grants" relevant to your project, search for faculty fellowships, publication awards, and smaller research stipend awards as well.

This document provides some additional information that can help you with your search, and includes links to several helpful grant databases.

Try this database from Duke University!

Also, we recommend mining any listservs and/or professional networks you might be a part of for ideas. Often, the perfect funding opportunity comes by word of mouth!

Feel free to reach out to request more information about how to search.

Step 3: Notify Your Dean, Chair, and ORSI of your Intent to Submit (4 weeks in advance)

Before you get too far into the process of crafting your proposal, you must notify your Department Chair, Dean, and ORSI (and any other potentially impacted personnel) about your intent to submit. Complete and distribute the Notice of Intent to Submit form at least 4 weeks in advance of your grant deadline. This step is crucial. Grant work often requires reassigned time, cost-share, the need for equipment, space, or other resources, or other factors that need institutional input before you can submit. This step applies to ALL grants regardless of project details.

Step 4: Write Your Proposal

Once you have the green light to submit, it’s time buckle down and write your grant! Consult with ORSI at any time (and multiple times!) during this process. We can help review your budget, give feedback on drafts, and coach you on how to pitch your idea to your chosen funder.

Step 5: Obtain Approvals (10 days in advance)

Submit the Grant Proposal Authorization Form, signed by your Dean, along with a complete draft of your narrative and budget to RSI no later than 10 business days before your grant deadline. ORSI will review your proposal, route for the remaining approvals, and let you know when you are cleared to submit.

Step 6: Submit Your Proposal!

The submission process will vary depending on the funder. For some systems, the Director of Research, Scholarship, and Innovation may need to be the one to press submit. We will confirm submission details with you as we help you prepare your proposal.

Step Limbo: Wait.

This part is never fun. We don't like this part.

Step 7: Receive Your Award and Start Your Project!

This part IS fun! If you are successful in getting your grant, contact ORSI right away so we can meet with you to discuss post-award management and next steps. And then go celebrate!

(If you are not funded, it’s a good idea to meet with us anyway so we can help you decipher feedback and prepare for potential resubmission. Often proposals are successful upon subsequent tries!)

Step 8: Manage Your Award

Award management will consist of a range of activities, forms, and reports. When you get your award, we will sit down with you to discuss post-award management and how to keep track of finances, and give you all the forms and information you need to use your award to its fullest. You can also find out more information about Current Grant Administration.

Step 9: Close Out Your Award and Submit Reports

We will help you every step of the way with this! Sit down with your ORSI grant administrator as your grant is coming to a close to make sure everything is wrapping up as it should be.

Step 10: Share Your Results!

Share them with your field, with the Naz community, and with us! We want to celebrate your grant-funded work, so please keep us informed of any publications, further projects, or other accolades that come from your work!

NAZARETH EARNS PRESTIGIOUS HEALTH GRANT

Nazareth was one of six awarded an National Institutes of Health (NIH) 2015 Biomedical and Biobehavioral Research Administration Development grant. The five-year, $433,000 grant supports faculty and staff professional development opportunities for success in securing external funds, which will lead to more student opportunities for mentored research. Read the press release.

Research reported in this press release was supported by the Eunice Kennedy Shriver National Institute Of Child Health & Human Development of the National Institutes of Health under Award Number G11HD085544. The content is solely the responsibility of the authors and does not necessarily represent the official views of the National Institutes of Health.

Useful Forms

Grant Proposal Authorization (completion required 10 business days prior to grant deadline)